In this post, you will be discovering the best online loan app platforms leveraging technology now in Nigeria! There is no gainsaying that technology is the future of every viable business as it keeps evolving! Today, with just a handy smartphone and an internet connection, you are set to transact round the world in an instant without a heck!

In this post, you will be discovering the best online loan app platforms leveraging technology now in Nigeria! There is no gainsaying that technology is the future of every viable business as it keeps evolving! Today, with just a handy smartphone and an internet connection, you are set to transact round the world in an instant without a heck!

These popular best online loan app platforms promises loans to their clients when they download the respective mobile apps from the relevant stores or sign up on the web for loans base on their business or personal needs and pay back within a specified period of time!

Subscribers are required to supply sensitive information about their bank identification details including their BVN (Bank Verification Numbers) so as to authenticate the transaction process for seamless transaction with assurance of high security checks!

5 Best Online Loan App Trending Now

Below are some of the paying best online loan app platforms lending now in Nigeria!

FairMoney

FairMoney is driven by the slogan “Making money better for everyone”, lending from N2,500 to N150,000! To qualify for the loan from FairMoney, clients are required to download their app from play store, sign up with Facebook and phone numbers, answer questions in 2 minutes, receive a loan offer, supply bank details and get an instant loan without collateral!

They offer flexible interest rates depending on client’s loan history, loans of up to N150,000 for returning customers, and an instalmental payments between 1, 2 or 3 months and another in the class of between 4 to 26 weeks, offer of higher loans at the first instance! The interest rates on loans roams around 5% to 28% without additional or hidden fees!

Palmcredit-Instant Loans

Palmcredit provides instant loans via mobile phone sign up. Lending is between N2000 to the N100,000 which is 50k short of what FairMoney lends. However, palm credit woos with client’s referral juices of up to N80,000!

Borrowing from Palmchat and repayments ranges between 91 to 180 days in total. Interest on loans falls between 14% to 24% an equivalent monthly interest of 4.6% and an annual percentage rate (APR) of 56.78%

Say for example your bid for N100,000 loan, after 180 days payable interest on loan accumulate to N24,000, meaning you are repaying N124,000 interest on loan inclusive which is representative of 56.79% APR

Loan offer follows three seamless procedures: Register, get approval, get disbursement to client’s bank account.

As at the time of writing this article, Palmcredit has got 4.6 Star rating and over 500,000 downloads

Carbon (Pay later)

Formerly Pay Later and now rebranded as Carbon. This fintech company has got 4.4 star rating as at the  time of writing this article. The selling point of this platform is its multifaceted features. It offers investment opportunities, seamless bill payment, recharging with airtime, making quick cash transfers etc. Here is Carbon’s website getcarbon.co

time of writing this article. The selling point of this platform is its multifaceted features. It offers investment opportunities, seamless bill payment, recharging with airtime, making quick cash transfers etc. Here is Carbon’s website getcarbon.co

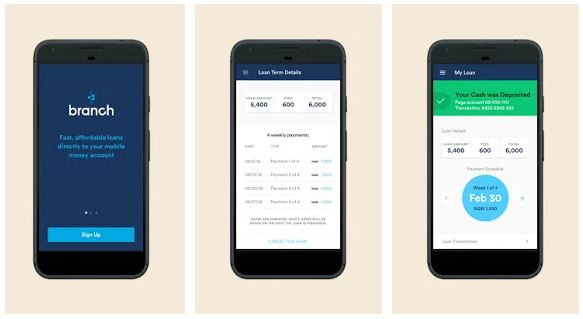

Branch:

At the time of this review, Branch has got 4.7 star rating. Branch promises fast processing within 24 hours of application! They loan between N1000 to N200,000.  Repayment term ranges between 4 to 64 weeks and an interest rate between 14 to 28 per cent with an equivalent monthly interest of 1% to 21% depending on borrowers loan options.

Repayment term ranges between 4 to 64 weeks and an interest rate between 14 to 28 per cent with an equivalent monthly interest of 1% to 21% depending on borrowers loan options.

They also promise, “no late or rollover fees and no collateral necessary”! Interest rates are also determined by some factors like payment history and the cost of lending for branch fintech lending solution providers. Here’s there site branch.com.ng

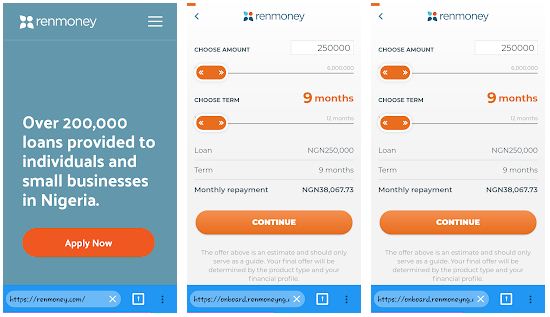

Renmoney

Renmomey is a Fintech company which provides quick and flexible loans to their prospective borrowers  by leveraging technology solutions as opposed to the traditional loaning environment. According to their mission statement, “our goal is to make your life easier, providing simple, flexible loans that are tailored towards you”. She boasts of her loan capacity of up to 4million Naira based on established criteria.

by leveraging technology solutions as opposed to the traditional loaning environment. According to their mission statement, “our goal is to make your life easier, providing simple, flexible loans that are tailored towards you”. She boasts of her loan capacity of up to 4million Naira based on established criteria.

With Renmoney, you do not need collateral. Interest and loans payable within the space of 3 to 12 months. Application and approval takes up to 24 hours before disbursement to client’s bank account. you can visits their website onboard.renmoneyng.com

DISCLAIMER:

This website is not affiliated in anyway with the loan lending platforms presented in this article. You might want to review privacy policies of the respective websites to understand their terms of services and how it affects you!